There was no presale, and the team does not take any of the tokens. Instead, everyone receives the exact same amount of LPs and ROOT tokens based on their ETH contribution. It doesnt matter when you contribute, early or last minute. All of this is hardcoded into the contracts and cannot change.

All of the ETH contributed will be locked into liquidity forever. This is a major factor is creating a price floor. To incentivize contributors for the lock-up risk, there is a fee on transfer of 1% paid to LP holders forever.

Instead of minting new coins to pay farmers, we take a transfer fee on market activity. Over time there's less ROOT in circulation as it's locked up into LPs and being burnt on transfer, so farmers are paid in a deflationary asset.

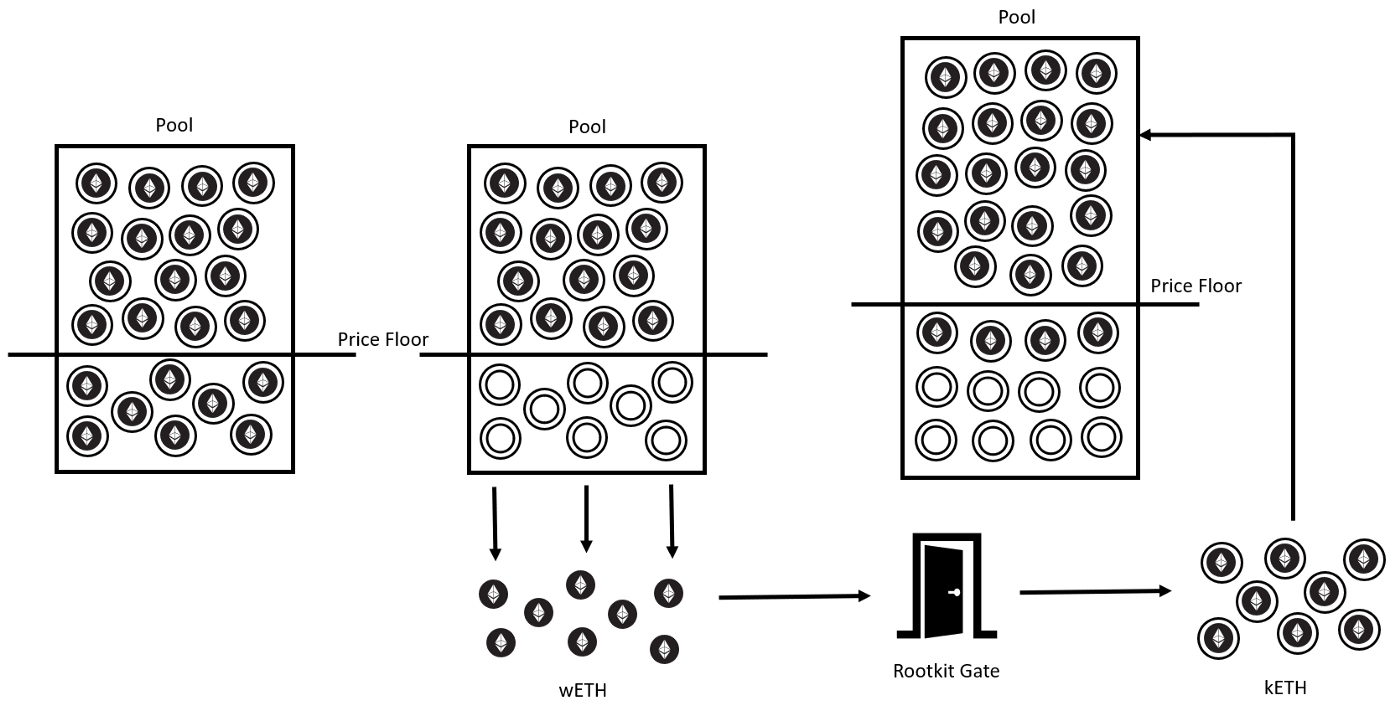

The price floor rises when there is less ETH than can be sold into it. Every Uniswap takes a fee 0.3%, and every token transfer burns 0.4%, this means all volume causes the floor to rise. When new LPs are created it raises the floor by the most, giving us the option to incentivize future LGEs

The price floor is the resulting price when you sell all circulating ROOT into the kETH/ROOT pool. You can go to Uniswap and check out how many ROOT are in liquidity, and how many are circulating to calculate this. The ETH under the price floor is trapped and would would typically be wasted, never to be recovered again. We are able to recover the value of the trapped ETH.

KETH is our version of WETH (Wrapped ETH) that we use in our main uniswap pair. The contract has a function to calculate the price floor, and if there is kETH stuck under the price floor, the wETH backing it will be removed and sent to a vault. The ETH below the floor that would normally be trapped forever can then be fed back into the system. Only kETH trapped under the price floor can have its backing removed, all available kETH can be redeemed at any time for wETH or ETH.

Since contributors receive LPs that are locked forever, and all ROOT tokens are in the pool, there is nothing to sell into the market and the price is at the floor. This means our kETH contract can return all of the contributed ETH for a second use right after the market is created. We use those funds to create an additional trading pair, and to market buy ROOT to split with the group before trading opens. This gives all contributors a chance to get ROOT before bots.

Any amount can be contributed. For each 1 ETH contributed you will receive the following:

- ROOT/KETH LP token: 2 ETH value

- ROOT/wBTC LP token: 0.25 ETH value

- ROOT token: 0.25 ETH value

The ROOT used to create the pool is provided for free, any future LP tokens created by adding to the pool will need to provide the value for both sides of the pair. It will cost 2 ETH in the future to create what you get for 1 ETH, with the bonus of some ROOT and a second LP token.

We don't anticipate that to be an issue with our market activity strategies. If volume doesnt pay enough to LPs, we can update the floor sweeper function to send a % as LP rewards when value is unlocked. The Vault opens up a huge list of creative options that were never possible before.

Rootkit is protected by Stoneface, a contract that owns other contracts and controls critical functions. Stoneface takes 7 days to change the Floor Calculator contract, that would give everyone enough time to exit the market and bring the ROOT price back to the floor. The ETH under the price floor isnt there, meaning we would get nothing. There is no incentive for the team to do this. The team gets 25% of the first ETH unlocked from under the price floor and a 0.1% ongoing transfer fee. We believe this is a fair payment for our work.

Stoneface can be verified and monitored here:

Rootkit Status Page

(view the source code)

First go to the ROOT/kETH pair on uniswap.info and see how much ROOT is in the pool

Then go to Etherscan and check the total root supply

(Total supply) -(supply in pool) = circulating supply

Go to the pair on Uniswap and see how much kETH you would get if you sold the entire circulating ROOT supply into the pool.

Now back to the pair on uniswap.info and check the total kETH in pool

(Total kETH in pool) -(Keth from selling all ROOT) = kETH under price floor

ROOT/kETH on Uniswap.info